-

AuthorPosts

-

-

The Development and

Comparative

Analysis of Stock

Exchanges in

Africa:

Abstract

The establishment and expansion of stock exchanges in Africa are vital for economic development, promoting financial integration, and attracting foreign direct investment (FDI). This paper examines the evolution of stock exchanges across the continent, with a focus on comparative analysis among key markets. Emphasis is placed on the disparities, challenges, and opportunities facing these markets, with a specific look at emerging exchanges like the Ethiopian Securities Exchange (ESX). The study highlights the role of these financial institutions in fostering regional integration and their potential to elevate Africa’s position in the global financial system.

Introduction

Stock exchanges are essential platforms for efficient resource allocation, offering opportunities for capital mobilization and wealth creation. While the concept of stock exchanges in Africa is relatively new compared to global markets, the rapid expansion of these financial hubs reflects the continent’s dynamic economic landscape. This paper explores the structure, performance, and unique features of African stock exchanges and presents Ethiopia’s newly launched securities exchange as a case study.

Overview of African Stock Exchanges

Africa hosts more than 30 stock exchanges, reflecting a blend of maturity and emerging potential. These exchanges serve as economic barometers for their respective regions. For instance:

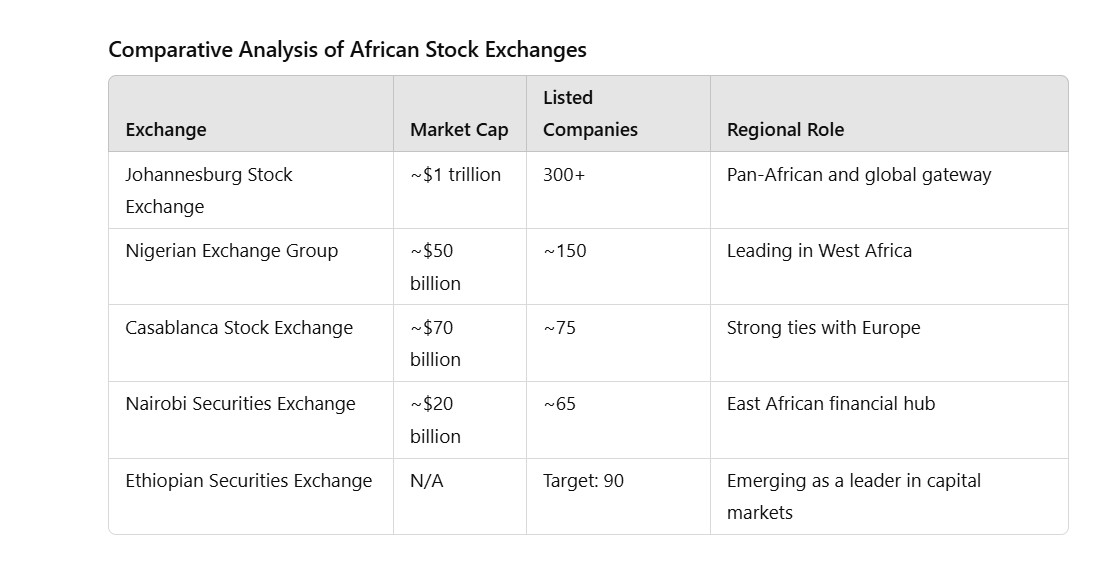

- Johannesburg Stock Exchange (JSE), South Africa:

- Market Capitalization: ~$1 trillion.

- Listed Companies: Over 300.

- Key Features: Africa’s largest and most developed exchange, leveraging advanced technology and robust regulatory frameworks.

- Nigerian Exchange Group (NGX), Nigeria:

- Market Capitalization: ~$50 billion.

- Listed Companies: ~150.

- Key Features: A leader in West Africa despite facing issues like currency instability.

- Casablanca Stock Exchange (CSE), Morocco:

- Market Capitalization: ~$70 billion.

- Listed Companies: ~75.

- Key Features: Strong connections with European markets, excelling in sectors like banking and real estate.

- Nairobi Securities Exchange (NSE), Kenya:

- Market Capitalization: ~$20 billion.

- Listed Companies: ~65.

- Key Features: Acts as the financial hub for East Africa, embracing green finance and technological innovation.

- Bourse Régionale des Valeurs Mobilières (BRVM), Ivory Coast:

- A regional exchange serving eight West African countries.

Other African Stock Exchanges Countries with operational stock exchanges include:

Egypt: Egyptian Exchange (EGX)

Ghana: Ghana Stock Exchange (GSE)

Botswana: Botswana Stock Exchange (BSE)

Zimbabwe: Zimbabwe Stock Exchange (ZSE)

Mauritius: Stock Exchange of Mauritius (SEM)

Tanzania: Dar es Salaam Stock Exchange (DSE)

Uganda: Uganda Securities Exchange (USE)

Ivory Coast: Bourse Régionale des Valeurs Mobilières (BRVM)

Ethiopia’s Entry: The Ethiopian Securities Exchange (ESX)

Ethiopia has launched its first securities exchange in five decades, marking a transformative step for the nation’s economic trajectory. With ambitions to attract domestic and foreign investment, the Ethiopian Securities Exchange (ESX) emerges as a platform for capital mobilization and financial inclusion in one of Africa’s most populous nations.

Ethiopia has maintained an average GDP growth rate of 8% over the past decade, despite facing challenges, including a civil war that disrupted economic activities. As part of its recovery efforts, the Ethiopian government has prioritized economic liberalization, including the partial privatization of state-owned enterprises and the creation of a domestic stock market.

Key initiatives include:

- Partial Privatization: The sale of shares in Ethio Telecom aims to raise 30 billion birr (~$234 million) through an initial public offering.

- Currency Reforms: The government has ended its longstanding currency controls, unlocking $20 billion in financing from the World Bank and International Monetary Fund.

- Youth Employment: With youth unemployment exceeding 25%, the ESX aims to create investment opportunities that spur job creation and economic participation.

The Ethiopian Securities Exchange (ESX)

Structure and Objectives

The ESX operates with three key segments:

- Equity Market: Providing a platform for companies to raise capital through the sale of shares.

- Fixed Income Market: Facilitating the issuance of government and corporate bonds.

- Money Market: Offering short-term financial instruments to businesses and institutions.

The ESX also aims to establish Ethiopia as a leader in Shariah-compliant finance, introducing products such as Sukuk bonds to cater to Islamic investors.

Key Features

- Ease of Investment: The government has implemented favorable regulations to facilitate fund repatriation for foreign investors.

- Modern Infrastructure: The exchange has integrated digital platforms for seamless trading and transaction processing.

- Regional Integration: As a member of the African Continental Free Trade Area (AfCFTA), Ethiopia intends to position the ESX as a regional financial hub.

Ethiopia’s Role in Africa’s Financial Landscape

The ESX’s establishment aligns with broader efforts to deepen Africa’s financial integration through initiatives like the AfCFTA. Ethiopia joins a growing list of African nations with stock exchanges, including South Africa, Nigeria, Kenya, Morocco, and Ghana.

The ESX could act as a bridge for investors seeking access to Eastern Africa’s markets while contributing to the continent’s overall financial development.

Comparative Analysis of African Stock Exchanges

Challenges Facing African Stock Exchanges

Challenges Facing African Stock Exchanges- Low Liquidity: Many markets experience low trading volumes and limited investor participation.

- Regulatory Inconsistencies: Inconsistent policies deter investments.

- Currency Volatility: Exchange rate fluctuations impact foreign investor confidence.

- Infrastructure Deficits: Smaller exchanges lack advanced trading systems.

Opportunities for Growth

- Regional Integration: Initiatives like the AfCFTA can foster interconnectivity among exchanges.

- Technology Adoption: Digital platforms and mobile investments can enhance market participation.

- Green Finance: Sustainable investment products can attract environmentally-conscious global capital.

Conclusion

The development of stock exchanges in Africa represents a critical step toward economic transformation and financial integration. While disparities exist among these markets, regional collaboration, technological advancements, and innovative financial products can unlock their full potential. Ethiopia’s new securities exchange exemplifies the continent’s ambition to modernize and strengthen its financial ecosystem.

Africa’s stock exchanges are poised to play a greater role in the global financial system, provided policymakers and stakeholders address existing challenges with a vision for long-term growth.

References

- African Securities Exchanges Association (ASEA).

- World Bank: Financial Development Reports.

- IMF: Regional Economic Outlook for Sub-Saharan Africa.

- Johannesburg Stock Exchange Annual Reports.

- Ethiopian Securities Exchange (2025) Launch Overview.

- Johannesburg Stock Exchange (JSE), South Africa:

-

Despite recent reforms, many African stock exchanges face low trading volumes and recent history of civil conflict and regional strife [ in some regions ], may deter investors local and international investors.

In addition, inconsistent regulatory enforcement could erode investor confidence. Economic & political stability, including transparent and predictable governance will be critical for success.

By aligning with regional initiatives like the AfCFTA and embracing innovative financial products, small/medium-size markets can re-position their economy’s which may serve as a catalyst for growth.

-

-

AuthorPosts

You must be logged in to reply to this topic.