-

OnkọweAwọn ifiweranṣẹ

-

-

Can Diaspora BONDS

Supercharge

Idagbasoke

INVESTMENT in

AFRICA in 2024?.

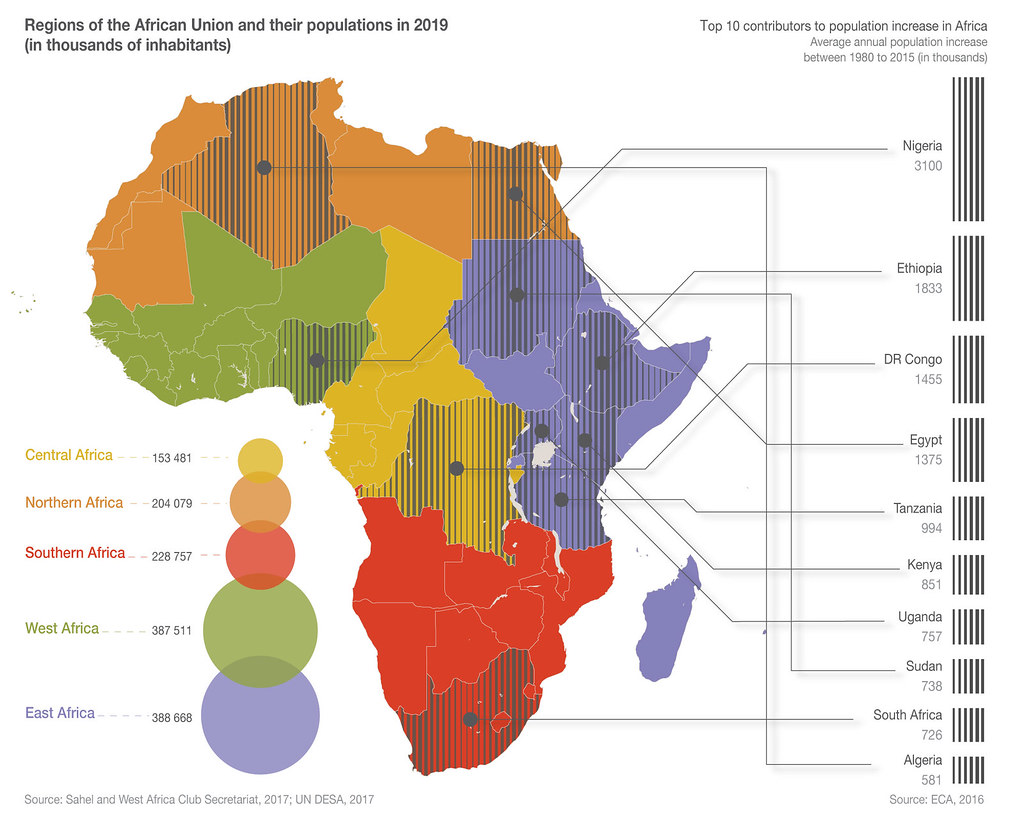

Le Diaspora ÌWÉ Supercharge Development IDOWO ninu AFRIKA ninu 2024? Lori awọn ti o ti kọja meji ewadun #diasporabonds have emerged as a compelling concept in development finance, gaining renewed attention amidst the economic challenges posed by the #COVID-19 crisis & the subsequent withdrawal of foreign #capital from #emergingmarkets. This innovative financing mechanism involves #governments raising substantial #funds from their expatriate communities through the issuance of #bonds – a fixed-income financial instrument.

A #diaspora bond functions as a government #debtsecurity, with #investors drawn from the country’s nationals living abroad, their descendants, or those with other connections to the nation. Proponents of diaspora bonds contend that governments can diversify this investor base while securing funding at below-market rates, often offering #bonds at patriotic discounts, particularly during times of crisis.

The potential benefits of diaspora bonds are manifold. Advocates argue that these bonds could generate tens of billions of dollars globally in annual investment, which, in turn, could be directed toward various development projects such as #infrastructure, #defense, and social initiatives that might not be as appealing to risk-averse international investors. Moreover, the diaspora itself benefits by having a secure financial vehicle that aligns with their altruistic ambitions to contribute to the development of their country of origin or ancestral homeland.

The appeal of diaspora bonds lies in their potential to tap into the strong emotional and #cultural ties that diaspora communities maintain with their countries of origin. It is believed that diasporas, driven by a sense of connection and commitment, may be particularly willing to take on the risk of lending to financially constrained developing #economies through this financial instrument.

While monetary remittances have traditionally been a significant avenue for diasporas to invest in their communities or families, diaspora bonds offer a structured and government-backed mechanism to channel funds for broader development purposes.

However, the success of diaspora bonds hinges on effective communication, trust-building, and transparent governance to ensure that investors view these instruments as reliable and impactful vehicles for contributing to the development of their nations.

-

Botilẹjẹpe ero ti awọn iwe ifowopamosi ti ilu okeere jẹ ifamọra to lagbara, aṣeyọri akiyesi rẹ ni a ti ṣakiyesi ni awọn orilẹ-ede meji nikan: Israeli ati India.

Awọn ṣiṣeeṣe ti iru awọn eto jẹ o ṣeeṣe, ṣugbọn kii ṣe idaniloju.

Crucially, the success of a diaspora bond initiative is contingent upon the homeland’s [ie; Africa’s] effective establishment of grassroots connections and proactive engagement with its diverse diaspora.

As both the diaspora and the homeland undergo adaptive processes and engage in reciprocal learning, the evolution of mutual trust becomes pivotal.

Ultimately, it is this trust that serves as the decisive factor in determining the success or failure of a diaspora bond or any analogous relational program.

J.

-

Diaspora Bond’s as a debt instrument has been successfully used to mobilize external development finance, particularly to fund large scale projects [in the case of India, during times when accessing international capital markets was challenging] – It has also been successful to keep the diaspora [in this case the Jewish Diaspora] engaged and connected to developments in their homeland.

I will argue that it can be an effective tool to bridge the gap between the global citizens of Africa, and the homeland, and to shape/influence domestic policy.

It is by far a stable and cheap source of debt to finance domestic projects, compared to the finance option and conditions of the International Monetary Fund [IMF].

-

@africamonetary, Mo gba pẹlu awọn idi ati idi ti nini ohun elo inawo, gẹgẹ bi awọn kan Diaspora Bond, ṣugbọn awọn nọmba kan ti awọn ipo nilo lati pade.

Awọn ọna ṣiṣe ofin: Awọn orilẹ-ede ti o ni awọn eto ofin ti o lagbara ati ti o han gbangba fun imuse adehun ni o rọrun lati fun iru awọn iwe ifowopamosi.

Iduroṣinṣin ilu: Absence of civil strife is an important factor.

Presence of Institutions: Having strong institutions, including national banks and other institutions in destination countries are important to guarantee bonds.

-

-

OnkọweAwọn ifiweranṣẹ

O gbọdọ wọle lati fesi si koko yii.