-

AuteurDes articles

-

-

Can Diaspora BONDS

Supercharge

Développement

INVESTMENT in

AFRICA in 2024?.

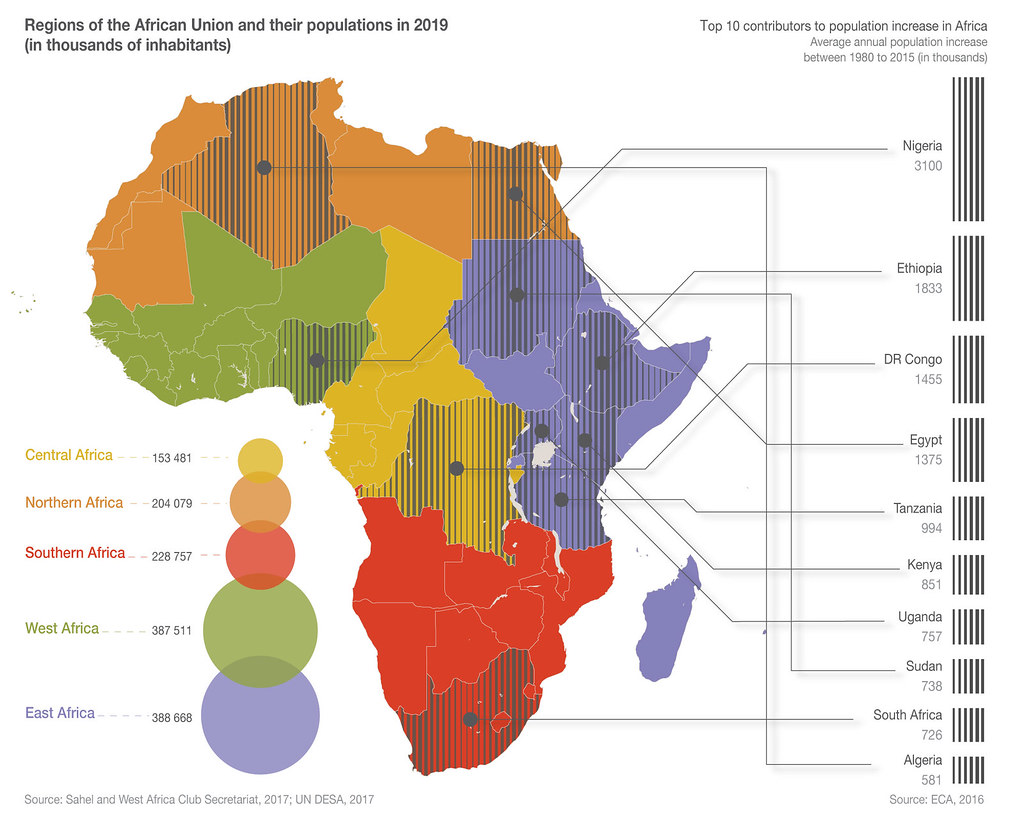

La diaspora peut-elle OBLIGATIONS Développement de la suralimentation INVESTISSEMENT dans AFRIQUE dans 2024? Au cours des deux dernières décennies Obligations de la diaspora # have emerged as a compelling concept in development finance, gaining renewed attention amidst the economic challenges posed by the #COVID-19 crisis & the subsequent withdrawal of foreign #capital from #emergingmarkets. This innovative financing mechanism involves #governments raising substantial #funds from their expatriate communities through the issuance of #bonds – a fixed-income financial instrument.

A #diaspora bond functions as a government #debtsecurity, with #investisseurs drawn from the country’s nationals living abroad, their descendants, or those with other connections to the nation. Proponents of diaspora bonds contend that governments can diversify this investor base while securing funding at below-market rates, often offering #bonds at patriotic discounts, particularly during times of crisis.

The potential benefits of diaspora bonds are manifold. Advocates argue that these bonds could generate tens of billions of dollars globally in annual investment, which, in turn, could be directed toward various development projects such as #infrastructure, #defense, and social initiatives that might not be as appealing to risk-averse international investors. Moreover, the diaspora itself benefits by having a secure financial vehicle that aligns with their altruistic ambitions to contribute to the development of their country of origin or ancestral homeland.

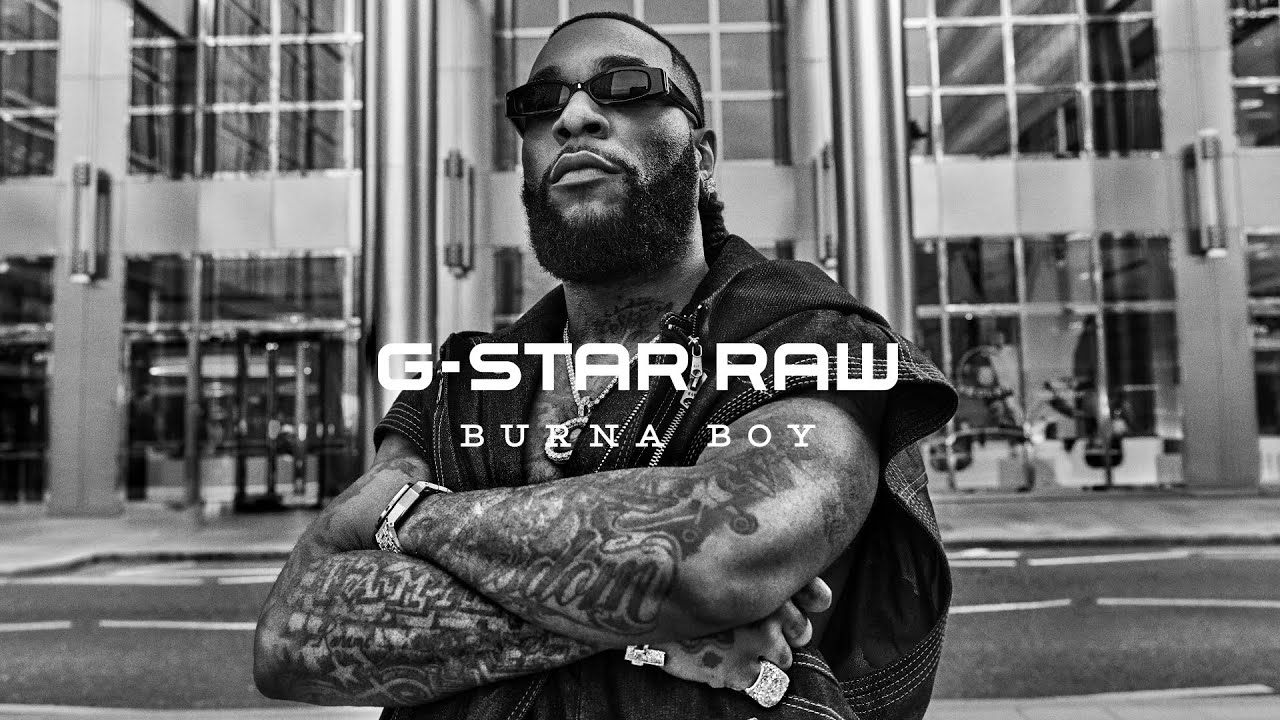

The appeal of diaspora bonds lies in their potential to tap into the strong emotional and #cultural ties that diaspora communities maintain with their countries of origin. It is believed that diasporas, driven by a sense of connection and commitment, may be particularly willing to take on the risk of lending to financially constrained developing #economies through this financial instrument.

While monetary remittances have traditionally been a significant avenue for diasporas to invest in their communities or families, diaspora bonds offer a structured and government-backed mechanism to channel funds for broader development purposes.

However, the success of diaspora bonds hinges on effective communication, trust-building, and transparent governance to ensure that investors view these instruments as reliable and impactful vehicles for contributing to the development of their nations.

-

Bien que le concept des obligations de la diaspora suscite un vif intérêt, son succès notable n’a été observé que dans deux pays : Israël et l’Inde.

La viabilité de tels programmes est plausible, mais pas assurée.

Crucially, the success of a diaspora bond initiative is contingent upon the homeland’s [ie; Africa’s] effective establishment of grassroots connections and proactive engagement with its diverse diaspora.

As both the diaspora and the homeland undergo adaptive processes and engage in reciprocal learning, the evolution of mutual trust becomes pivotal.

Ultimately, it is this trust that serves as the decisive factor in determining the success or failure of a diaspora bond or any analogous relational program.

J

-

Diaspora Bond’s as a debt instrument has been successfully used to mobilize external development finance, particularly to fund large scale projects [in the case of India, during times when accessing international capital markets was challenging] – It has also been successful to keep the diaspora [in this case the Jewish Diaspora] engaged and connected to developments in their homeland.

I will argue that it can be an effective tool to bridge the gap between the global citizens of Africa, and the homeland, and to shape/influence domestic policy.

It is by far a stable and cheap source of debt to finance domestic projects, compared to the finance option and conditions of the International Monetary Fund [IMF].

-

@africamonetaryJe suis d’accord avec la logique et l’objectif d’un instrument financier tel qu’une obligation de la diaspora, mais un certain nombre de conditions doivent être remplies.

Systèmes juridiques : Les pays dotés de systèmes juridiques solides et transparents en matière d’exécution des contrats trouvent plus facile d’émettre de telles obligations.

Stabilité civile : Absence of civil strife is an important factor.

Presence of Institutions: Having strong institutions, including national banks and other institutions in destination countries are important to guarantee bonds.

-

-

AuteurDes articles

Vous devez être connecté pour répondre à ce sujet.