-

AuteurDes articles

-

-

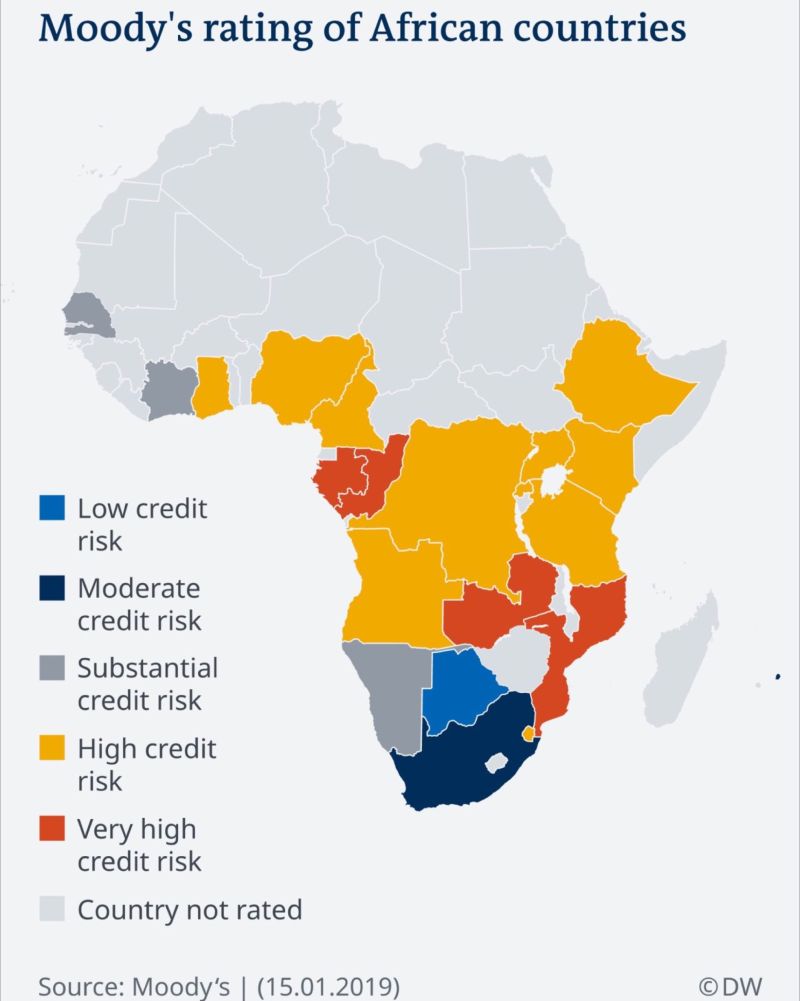

African Credit

Ratings:

Criticism of credit rating agencies by African nations has been argued to be red herring; with seemingly recent findings suggesting no inherent negative bias towards countries in the region. As a global debt crisis unfolds, particularly impacting low-income countries in Sub-Saharan Africa, more than half of which are deemed to be in or at high risk of debt distress, sovereign defaults have resurged. African frontier market sovereigns, once favored by global investors, now find themselves largely excluded from issuing new international #bonds, facing soaring average #yields on hard currency bonds.

Particularly in the wake of a wave of downgrades since the onset of the pandemic, African finance ministers, grappling with credit rating reductions, often express dissatisfaction, accusing agencies of overlooking the strengths of their countries and suggesting a bias.

Notable voices, such as Ghana’s finance minister Ken Offori-Atta and Senegal’s president Macky Sall, have publicly questioned the fairness of these ratings, with references to Dante’s inferno and assertions that perceived risk is higher than actual risk.

In response, credit rating agencies contend that they apply a consistent set of criteria across all #sovereigns, regardless of their global location. However, critics argue that the agencies’ methodologies, especially in evaluating factors like institutional strength and policy predictability, introduce subjective elements. Finance ministers from frontier countries, feeling the impact of what they perceive as discriminatory practices, may have a valid point in their concerns.

While credit rating agencies maintain a stance of impartiality, the discretionary nature of their methodologies allows room for debate. The frustration expressed by finance ministers in frontier countries underscores the need for transparency and a thorough examination of the criteria applied in assessing sovereign creditworthiness. The ongoing debate raises questions about the potential biases within credit rating processes and the need for a nuanced evaluation of the complex dynamics shaping the financial landscape of African nations.

-

-

AuteurDes articles

Vous devez être connecté pour répondre à ce sujet.